Report on development of national tax system

- 5

- 4:14

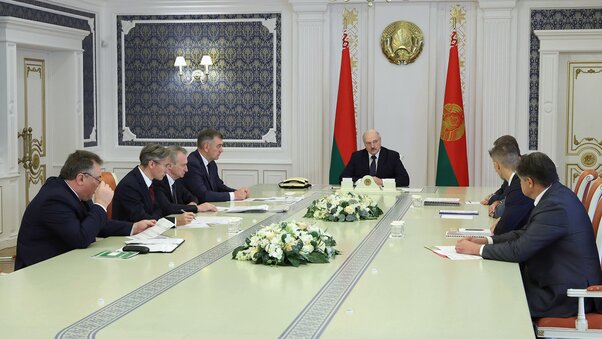

The tax system of Belarus should be simple and understandable to all citizens, Belarus President Aleksandr Lukashenko said as he heard out a report on the development of the national tax system on 12 October.

The meeting was attended by First Vice Premier Nikolai Snopkov, Taxes and Duties Minister Sergei Nalivaiko and Finance Minister Yuri Seliverstov.

“Given a lot has been recently said about the redistribution of authorities, some officials obviously lack them, and this is right: the government and other authorities should do more and address non-characteristic matters instead of the President. I have recently received a note: a proposal was made to redirect 71 authorities from the President to all levels of power. But this is a separate subject, this is a kind of introduction to the main issue on the agenda. I absolutely do not want to interfere with the work of the government. Nevertheless, I want to discuss the improvement of our tax system with you,” Aleksandr Lukashenko said.

The President remarked that the tax system is one of the key elements of the economic policy; it should be easy and understandable to people. “We have done a lot in this field. But I remember we agreed that you will prepare a new, more exquisite taxation system, that you will upgrade the existing Tax Code where necessary and where possible. Our Tax Code is rather good, but nothing is perfect and we must always strive for improvement,” the head of state stressed.

In his words, the Tax Code should be “refreshed” just like the Code on Administrative Violations and the Code of Execution Procedure on Administrative Violations. “Good job was done. Perhaps, after the recent events we will have to amend some articles. Probably, this is life. We need to do the same with the Tax Code. Of course, there will be less work, less amendments, but we need to do it,” Aleksandr Lukashenko said. “Of course, the government and other agencies will work on it, but I will keep this matter under control.”

According to the President, it is also necessary to continue the digitization of the tax legislation. “The prime minister of Russian (he personally worked on this matter, we are in close contact) suggested that we should look at the tax system of the Russian Federation. Some people view it as the most balanced one. But if they have made more progress in some areas, we should not be afraid to use their best practices. Moreover, if they are sharing it with us for free – software and other things. We need to facilitate the process of digitization and to make the tax system more transparent. The tax recovery should be closer to 100%,” the head of state said.

At the same time, he remarked that a lot has been already done in this area in Belarus. Aleksandr Lukashenko asked if there was an expected outcome and what solutions would be taken in the near future.

According to Sergei Nalivaiko, tax authorities generating almost 70% of the consolidated budget revenues collected Br17.7 billion worth of taxes in January-August. “The planned assignment of the consolidated budget has been fulfilled by 96.5%. The shortage made up Br700 million. This is mostly attributed to the epidemiological situation in the world,” the minister explained.

“If we manage to keep this level, it will be okay. We need to do our best to reduce the shortage a little bit, although it will not be easy. You see that the second wave has started in the world. And our economy is export oriented, we depend on it. We need at least to maintain these parameters,” the President said.